"...as long as the dictatorships exist, war is inevitable, and that it may be better to have war now, when we have an issue that may be supposed to appeal to the whole world, rather than to put it off to some future date when our position may be more difficult and dangerous." - Statement by Sir Samuel Hoare, Secretary of State for the Home Department, British House of Commons, October 3, 1938 after the Munich Pact

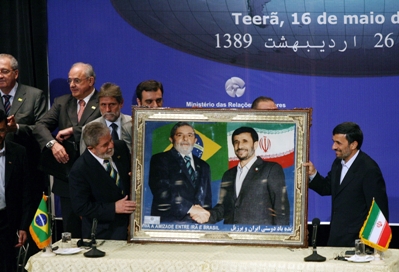

The difficult and dangerous time arrived this week for the United States when its Nato ally Turkey and supposed Latin American friend Brazil provided the Teheran Tyranny a fig leave to continue its drive for nuclear primacy in the Middle East.

As the Heritage Foundation´s blog, The Foundry, notes: "[The agreement] would only deflate the perceived urgency of imposing sanctions on Iran while allowing Tehran to advance its nuclear weapons program with impunity."

Thus, Iran will have nuclear weapons and the ballistic missiles to deliver them to Tel Aviv and Washington. It is astonishing that this is an acceptable toll for Washington to pay.

The West has failed just as GSM forecast in its Net Assessment: Iran last year.

In the short run, the US Administration´s pusillanimous policy toward Iran, best qualified as "Sanctions or Bust," is at a dead end.

While headlines speak of Russia and China aboard, there is little chance enough UN Security Council members will vote for any sanctions given the Turkey nuclear fuel swap deal.

Some policy wonks actually believe in the Teheran Tyranny´s peaceful intentions. No, Ms. Slavin, Iran cannot deliver on a deal it reneged on before.

Iran has no peaceful intentions. The Teheran Tyranny has not engaged in deceit, deception, and duplicity to just throw away an expensive public and hidden nuclear program. Terror, Inc. is not building longer-range ballistic missiles for a rainy day.

The rogue regime in Teheran is dead serious in continuing to inflict as much harm as possible against the Israel and the United States and their allies and interests. To believe otherwise is beyond naive.

As a young John F. Kennedy wrote before World War II after the failed Munich Pact: "Appeasement was, therefore, as I have said, partly based on the mistaken belief that peace might be achieved by concession but it was also a realistic hard-headed policy of playing for time."

For freedom lovers worldwide, that time is nearly up. A nuclear Iran is a game-changer in the global security calculus.

As like Munich, paper-mache charades like the nuclear deal brokered by Turkey and Brazil with the Iranian dictatorship does not prevent war, but make it more certain.

***

Global Security Headlines

Wednesday, May 19, 2010

Sunday, May 16, 2010

Bloomberg - EU disintegration?

Euro Falls to Lowest Since Lehman as Breakup Concern Increases

May 15 (Bloomberg) -- The euro fell to its lowest level since the collapse of Lehman Brothers Holdings Inc. on concern that the 16-nation currency may be headed for disintegration.

GSM has long held the view that the EU was a faux union and the euro a faux currency.

We will monitor the events as always as they unfold.

May 15 (Bloomberg) -- The euro fell to its lowest level since the collapse of Lehman Brothers Holdings Inc. on concern that the 16-nation currency may be headed for disintegration.

GSM has long held the view that the EU was a faux union and the euro a faux currency.

We will monitor the events as always as they unfold.

Friday, May 14, 2010

Euro Crisis Deepens - On to Spain

As Spain´s El Pais reports, Madrid´s Ibex Index today registra su peor sesión del año con un desplome del 6,64% (registers its worse fall this year -6.64%) as investors flee the euro.

In an accompanying article, Josef Ackermann (Deutsche Bank) ha puesto en duda que Grecia sea capaz de pagar toda su deuda pese al plan de rescate acordado con la UE y el FMI (doubts Greece has the ability to pay all its debt despite the EU-FMI rescue plan).

The London Times cites another El Pais report that French President Sarkozy threatened to yank France from the euro in a meeting of Euro ministers in Madrid.

Socialist President Zapatero of Spain, the current EU president, has proved ineffectual in steering the EU as he has during his tenure in Madrid.

Socialist President Zapatero of Spain, the current EU president, has proved ineffectual in steering the EU as he has during his tenure in Madrid.

The aloof technocrat lacks the imagination to lead and the ideas to save his own country from financial ruin. Discredited economic policies only compound his effeteness.

The current Euro crisis was not unpredictable by many accounts, as GSM has often noted, given the failed socialist economic policies by the overextended welfare states.

The unsustainable European welfare states and their faux currency were on the radar screens of intelligence experts as far back as 2005: In 2005, U.S. intelligence warned of Euro econ crisis and EU's demise unless welfare states downsized.

There euro-contagion is about to consume its next victim.

In an accompanying article, Josef Ackermann (Deutsche Bank) ha puesto en duda que Grecia sea capaz de pagar toda su deuda pese al plan de rescate acordado con la UE y el FMI (doubts Greece has the ability to pay all its debt despite the EU-FMI rescue plan).

The London Times cites another El Pais report that French President Sarkozy threatened to yank France from the euro in a meeting of Euro ministers in Madrid.

Socialist President Zapatero of Spain, the current EU president, has proved ineffectual in steering the EU as he has during his tenure in Madrid.

Socialist President Zapatero of Spain, the current EU president, has proved ineffectual in steering the EU as he has during his tenure in Madrid.The aloof technocrat lacks the imagination to lead and the ideas to save his own country from financial ruin. Discredited economic policies only compound his effeteness.

The current Euro crisis was not unpredictable by many accounts, as GSM has often noted, given the failed socialist economic policies by the overextended welfare states.

The unsustainable European welfare states and their faux currency were on the radar screens of intelligence experts as far back as 2005: In 2005, U.S. intelligence warned of Euro econ crisis and EU's demise unless welfare states downsized.

There euro-contagion is about to consume its next victim.

Wednesday, May 12, 2010

EU Crisis Endures on all fronts

The European Union is not likely to survive its current political, economic, and social challenges.

To read the current crisis solely through the economic lens is myopic.

Political Problems Perculate

The comic Cameron- Clegg Coalition in London, the United Kingdom, will not last.

The UK´s ambivalance toward the EU is well- known and newly- minted Prime Minister Cameron is a pronounced Euro- skeptic. Political instability in one of Europe´s most important states does not bode well for the Continent.

Centrist Chancellor Merkel is under mounting pressure and probably lost a key regional election last Sunday as part of the fallout from the bailout of Greece.

Last March, the UMP Party of President Sarkozy was " thrashed" in regional elections in France.

And now on to beleaguered but beloved Spain where President Zapatero, nearing the end of his 6- month term as the current leader of the European Union, is enacting only tepid measures to tamp down the burgeoning debt despite IMF support.

The absence of political will to make tough choices will only likely shortly postpone more drastice measures. The myriad alphabet soup of unions is already sharpening their swords to oppose even these weak moves.

Economic Strictures

The IMF sees Europe´s economy in a " tenuous recovery" and actually there is no basis to believe the EU economies will recover anytime soon.

There is no single unified economic entity backing up the euro like the United States for the dollar. The euro is a faux currency like the EU is a faux union.

"L'incertitude domine," ( Uncertainy reigns) says Jean-Claude Trichet, president of the European Central Bank, as quoted in Le Figaro.

The uncertainty surely lingers when the $1 trillion resuce plan for Greece and the euro proves incapable of saving both. Greece will surely cede to EU pressure and leave the euro zone.

It can only be ironic that Spain is one of the sick economies at the same time it heads the dizzingly merry- go- round EU presidency.

Social Fallout

The question must be if the current leaders in Europe can control the streets.

The battles between Greek police and protestors, including invasion of government buildings, is just the tip of the iceberg.

Central governments from Lisbon to Athens through socialist economic policies have produced large dependent class of citizens who see their security eroding ( rightly) with the austerity measures that have to be implemented to try to calm the markets and have a chance to save the EU project.

The social market system is an abject failure because in the end there is not enough money to back the promises of the politicians for cradle-to-grave upkeep of their voters.

Conclusions

The Europe Union continues to unravel. Its fundamentals are rickety.

The weight of debt is crushing to economies that barely produce anything the world consumer wants to buy.

Again, where is the EU´s Microsoft, Apple or Intel?

Bureaucrats in Brussels are a poor substitute and political-social economic policies that punish success and wealth yield... well, less success and wealth.

Until Europe rids itself of pathetic socialist economic policies, its schlerotic economic growth will persist and in the end the invisible hand will deal a knockout blow.

***

To read the current crisis solely through the economic lens is myopic.

Political Problems Perculate

The comic Cameron- Clegg Coalition in London, the United Kingdom, will not last.

The UK´s ambivalance toward the EU is well- known and newly- minted Prime Minister Cameron is a pronounced Euro- skeptic. Political instability in one of Europe´s most important states does not bode well for the Continent.

Centrist Chancellor Merkel is under mounting pressure and probably lost a key regional election last Sunday as part of the fallout from the bailout of Greece.

Last March, the UMP Party of President Sarkozy was " thrashed" in regional elections in France.

And now on to beleaguered but beloved Spain where President Zapatero, nearing the end of his 6- month term as the current leader of the European Union, is enacting only tepid measures to tamp down the burgeoning debt despite IMF support.

The absence of political will to make tough choices will only likely shortly postpone more drastice measures. The myriad alphabet soup of unions is already sharpening their swords to oppose even these weak moves.

Economic Strictures

The IMF sees Europe´s economy in a " tenuous recovery" and actually there is no basis to believe the EU economies will recover anytime soon.

There is no single unified economic entity backing up the euro like the United States for the dollar. The euro is a faux currency like the EU is a faux union.

"L'incertitude domine," ( Uncertainy reigns) says Jean-Claude Trichet, president of the European Central Bank, as quoted in Le Figaro.

The uncertainty surely lingers when the $1 trillion resuce plan for Greece and the euro proves incapable of saving both. Greece will surely cede to EU pressure and leave the euro zone.

It can only be ironic that Spain is one of the sick economies at the same time it heads the dizzingly merry- go- round EU presidency.

Social Fallout

The question must be if the current leaders in Europe can control the streets.

The battles between Greek police and protestors, including invasion of government buildings, is just the tip of the iceberg.

Central governments from Lisbon to Athens through socialist economic policies have produced large dependent class of citizens who see their security eroding ( rightly) with the austerity measures that have to be implemented to try to calm the markets and have a chance to save the EU project.

The social market system is an abject failure because in the end there is not enough money to back the promises of the politicians for cradle-to-grave upkeep of their voters.

Conclusions

The Europe Union continues to unravel. Its fundamentals are rickety.

The weight of debt is crushing to economies that barely produce anything the world consumer wants to buy.

Again, where is the EU´s Microsoft, Apple or Intel?

Bureaucrats in Brussels are a poor substitute and political-social economic policies that punish success and wealth yield... well, less success and wealth.

Until Europe rids itself of pathetic socialist economic policies, its schlerotic economic growth will persist and in the end the invisible hand will deal a knockout blow.

***

Saturday, May 8, 2010

A Grim Future for the EU - Report

The spring of the EU's discontent is doubled by a report from a distinguished group of former leaders who paint a grim future for the so-called union: Un rapport sur l'avenir de l'Europe met en garde contre sa «marginalisation» face à l'Asie (A report on the future of Europe warns against "marginalization" by Asia).

As Europe commemorates "the European journey" on Sunday, May 9, with the 60th anniversary of the Schuman Declaration, a report by the EU's "Group of Wise Ones" delivered on Saturday, May 8, is less optimistic and warns against the "marginalization" by Asia.

GSM thought the crises (plural) so severe facing the EU - from immigration and energy woes to the fear of a growing youthful and angry Muslim population to the failed welfare state - that it ranked as our 6th Strategic Question for 2010. In February we pointed out that the EU is Evaporating.

The premises of the EU sow the seeds of its current (and continuing) problems. Namely, the nation-states cannot disown their political, economic, and social history for a pan-European vision of cooperation, unity, and a "one for all and all for one" sentiment.

Secondly, socialism is a costly failed economic system. The EU is sinking fast because it cannot afford its generious welfare state.

Socialism is based on theft. After stealing the wealth from the risk-takers and the productive, the "Golden Goose" is eventually killed. Little productivity, less innovation, and mounting debt compared to other economic actors in the world do marginalize the faux European union.

While Greece, Portugal, and Spain figure heavily in the current economic crisis, other EU states are far from perfect models for economic success.

The entire EU experiment is in question and the continuing decline of the euro currency inexorably leads to a possibly frightful denouement.

***

If you need research from open sources in Spanish, French, or Portuguese and presented in a stylish English language report or a translation of documents in said languages to English, please contact Professor Winn at by sending an email to mrenglish101@gmail.com for a prompt evaluation.

Alors que l’Europe commémore dimanche 9 mai 2010 - la journée de l’Europe -, le 60e anniversaire de la Déclaration Schuman, un rapport du « groupe des Sages » de l’UE rendu samedi 8 mai sur l’avenir de l’Europe n’est pas très optimiste et met en garde contre la « marginalisation » du continent face à l'Asie.

As Europe commemorates "the European journey" on Sunday, May 9, with the 60th anniversary of the Schuman Declaration, a report by the EU's "Group of Wise Ones" delivered on Saturday, May 8, is less optimistic and warns against the "marginalization" by Asia.

GSM thought the crises (plural) so severe facing the EU - from immigration and energy woes to the fear of a growing youthful and angry Muslim population to the failed welfare state - that it ranked as our 6th Strategic Question for 2010. In February we pointed out that the EU is Evaporating.

The premises of the EU sow the seeds of its current (and continuing) problems. Namely, the nation-states cannot disown their political, economic, and social history for a pan-European vision of cooperation, unity, and a "one for all and all for one" sentiment.

Secondly, socialism is a costly failed economic system. The EU is sinking fast because it cannot afford its generious welfare state.

Socialism is based on theft. After stealing the wealth from the risk-takers and the productive, the "Golden Goose" is eventually killed. Little productivity, less innovation, and mounting debt compared to other economic actors in the world do marginalize the faux European union.

While Greece, Portugal, and Spain figure heavily in the current economic crisis, other EU states are far from perfect models for economic success.

The entire EU experiment is in question and the continuing decline of the euro currency inexorably leads to a possibly frightful denouement.

***

If you need research from open sources in Spanish, French, or Portuguese and presented in a stylish English language report or a translation of documents in said languages to English, please contact Professor Winn at by sending an email to mrenglish101@gmail.com for a prompt evaluation.

Subscribe to:

Comments (Atom)